McKeen’s Hockey: Dynasty Stock Watch

The Dynasty Stock Watch is designed to go team-by-team across the NHL and evaluate which prospects dynasty managers should be looking to buy and which they should be looking to sell. The goal isn’t to rank prospects in a vacuum, but to assess their current fantasy market value relative to long-term upside. “Buy” candidates are players whose cost is likely lower than their future production potential, creating opportunities to acquire them before their stock rises. “Sell” candidates are players whose value is inflated by pedigree, recent performance, or name recognition, making it a good time to cash out before regression or role limitations set in. Each installment provides dynasty-specific context, helping you navigate short-term hype and long-term sustainability in building your roster.

New York Rangers Edition

Team Outlook

The Rangers missed the playoffs in 2024-25, which signaled that the roster can no longer rely solely on a few stars to carry them. They still have elite talent in Artemi Panarin, Adam Fox, Igor Shesterkin, and re-acquired JT Miller, but the supporting cast has been inconsistent. The organization now needs its young players to step forward, not just as depth options but as impact contributors who can drive play and provide scoring support.

A major franchise question looms around Artemi Panarin’s future, as he is set to become a free agent after the 2025-26 season. If he re-signs, the Rangers can continue to push in a win now direction. If he leaves, the team may be forced to retool around a younger core. Either way, the development and emergence of their prospects will determine how competitive they remain. For dynasty managers, this creates a crucial window to track which young players are positioned to seize larger roles, because opportunity in New York could open up dramatically over the next one to two years.

Buy Candidates

Gabe Perreault (RW, 20)

Why Buy?

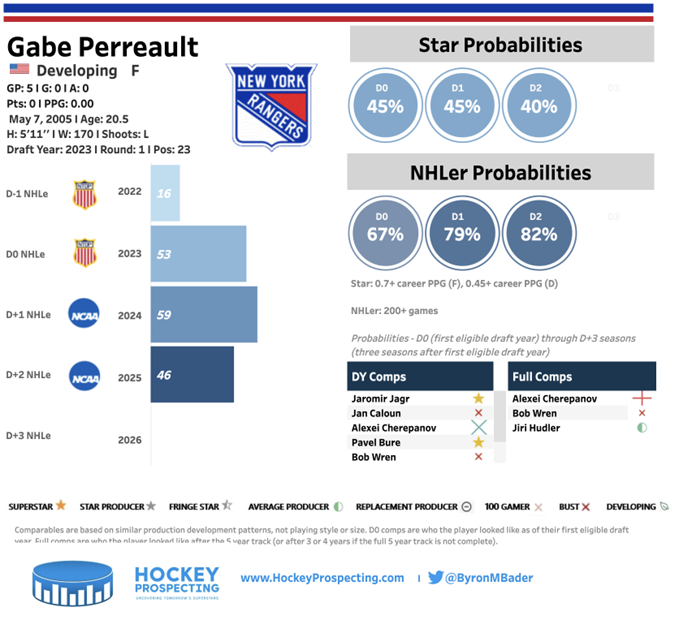

After a stellar run with the USNTDP and an immediate impact at Boston College, Perreault is beginning his professional career in the AHL. Some dynasty managers may view this as a step back, but it is more a reflection of the Rangers’ depth than any concern with his development. Perreault’s hockey IQ and playmaking ability are among the best of any prospect in the game. His skating still divides scouts, but his ability to anticipate play, create in tight spaces, and elevate linemates is elite. Once he adjusts to the pace of the pro game, his vision and touch should translate seamlessly.

Because New York’s top six is loaded, his NHL timeline may stretch slightly, which has temporarily kept his fantasy cost reasonable. That creates a perfect buying window for patient managers. His long-term projection still includes top six usage and power-play time, and his upside remains that of a high-end offensive contributor. If anyone in your league believes the AHL assignment lowers his ceiling, this is the time to send a trade offer. Patience now could lead to a major payoff when he becomes a core fantasy asset.

Scott Morrow (D, 22)

Why Buy?

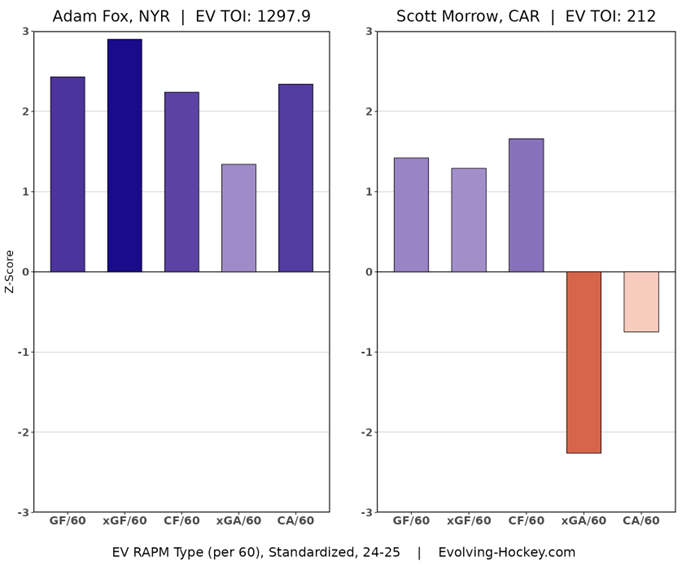

Morrow may never completely replace Adam Fox, but the gap might be smaller than people think. His size, mobility, and offensive instincts make him one of the most intriguing blueliners in the Rangers’ system. Adam Fox’s production has quietly trended downward over the past few seasons, and after his poor performance at the Four Nations Face-Off, there is growing scrutiny about who might eventually take over top offensive duties. Importantly, Morrow’s Regularized Adjusted Plus-Minus (RAPM) chart via Evolving Hockey from last season shows that, in limited NHL action, he already drives offense at a high level. He does, however, still need to refine his defensive acumen, which is typical for young offensive defensemen. If the Rangers split power-play units or Fox misses time, Morrow is the most likely candidate to step in.

His demotion to the AHL to start the season was more about his waiver-exempt status than his performance, which creates an ideal buying window. Dynasty managers often overreact to assignments, assuming a player is not ready, when in reality Morrow is close to NHL usage and just needs reps. His transition to pro hockey has been smooth, and his long-term opportunity remains tied to one of the best offensive environments in the league. If anyone in your league views him as blocked or unimpressive, use that to your advantage in trade negotiations. Stashing him now could yield a quick and significant payoff once the opportunity opens up.

Dylan Garand (G, 23)

Why Buy?

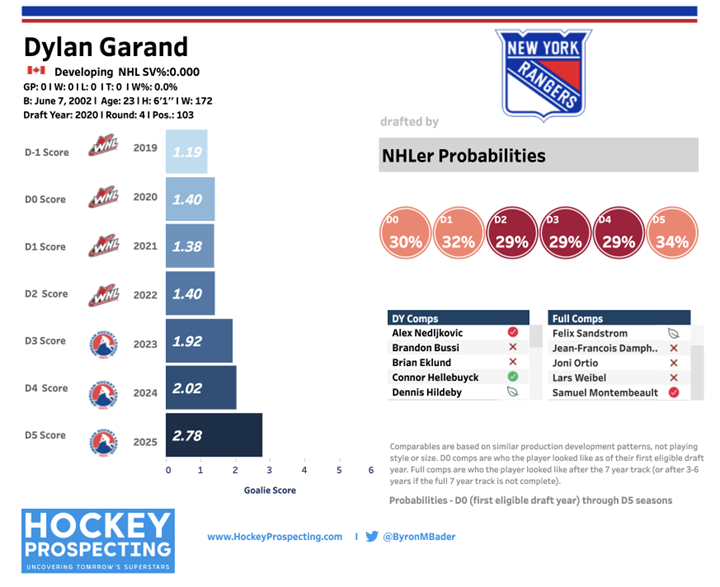

Goaltending prospects are always volatile, but Garand has quietly built one of the stronger development curves among young goalies. After a rough adjustment to the professional level in the AHL, he bounced back in a big way last year and became one of Hartford’s most reliable players. His Hockey Prospecting model shows roughly a 34 percent chance of becoming an NHLer, which is a strong projection for a goaltender. One of his top historical comparables is Sam Montembeault, who took a few years to find his footing and earn a real opportunity, but is now thriving as an NHL starter. Garand could follow a similar trajectory. Although he is slightly undersized by modern standards, he has a strong technical foundation, excellent compete level, and a proven winning pedigree, including backstopping Canada to gold at the 2022 World Junior Championship.

With Igor Shesterkin locked in as the starter, Garand profiles as one of the better future backup or 1B options in the league. If Shesterkin ever misses time, Garand could step into a strong Rangers roster and immediately provide wins and quality rate stats. The Rangers do not have many other viable internal candidates at the position, which further boosts his long-term opportunity. His dynasty acquisition cost remains low because he is currently blocked, but that is exactly what makes him a smart stash. Quality insurance goaltenders are incredibly valuable in deep formats, and Garand has both the skill and situation to outperform expectations once he gets his chance. This is the ideal time to buy before his value climbs.

Sell Candidates

Malcolm Spence (LW, 19)

Why Sell?

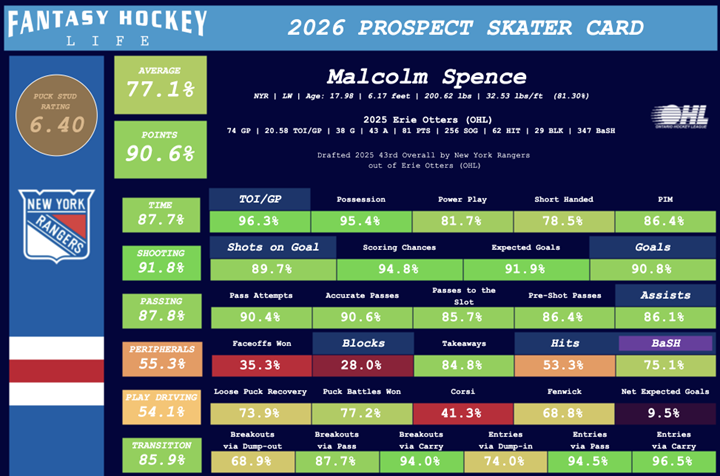

Spence’s speed, energy, and relentless motor made him an exciting draft pick, and his compete level is one of the best in his class. He plays with pace, tracks well, and does all the little things coaches love. However, from a fantasy perspective, his offensive toolkit is not as refined as other forward prospects, and he profiles more as a middle-six complementary winger than a primary scorer. His fantasy hockey life skater card shows a solid peripheral floor, but without strong point production, that alone will not carry his value in most formats. In short, he is likely to be a better real-life player for the Rangers than a high-end fantasy asset.

Right now, Spence still carries “draft shine,” and his strong start to his NCAA career may cause some managers to overestimate his long-term ceiling. This creates the ideal selling window. His name value and perceived upside may currently outweigh his true offensive projection. Dynasty managers should consider moving him before reality sets in and his value normalizes. If someone in your league believes he has top-six scoring upside, capitalize on that now and sell while the market is still inflated.

Brendan Brisson (LW/RW, 23)

Why Sell?

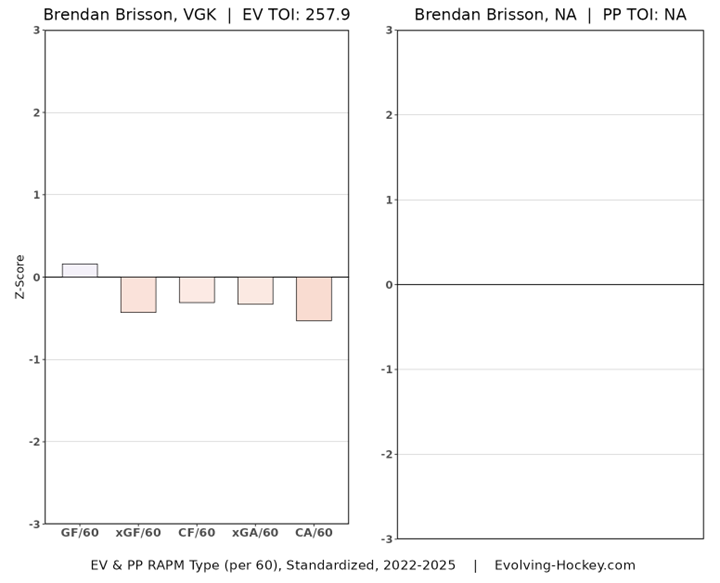

Brisson’s shot has always been his standout tool, and he built a strong reputation through his draft pedigree and international play. However, he was unable to crack the lineup with the Vegas Golden Knights, which was an early warning sign that his game might not translate as well as hoped. After being traded to the Rangers, he now faces another crowded forward group with limited openings in the top six. His RAPM chart via Evolving Hockey shows that his offensive impact, measured through expected goals, is not above NHL average, and his defensive results are poor. There simply is not enough value away from the puck to offset the inconsistency in his scoring.

Despite these concerns, his name still carries value in many dynasty leagues due to past production and his reputation as a scorer. Though it may be past time to sell, you can and should see what you can get. Someone in your league may still be willing to give him another chance, hoping he can rediscover his offense with a change of scenery. If that opportunity arises, you should make the trade. His long-term projection looks more like a depth winger with limited fantasy upside, and it is better to move him before that becomes obvious to everyone.

EJ Emery (D, 19)

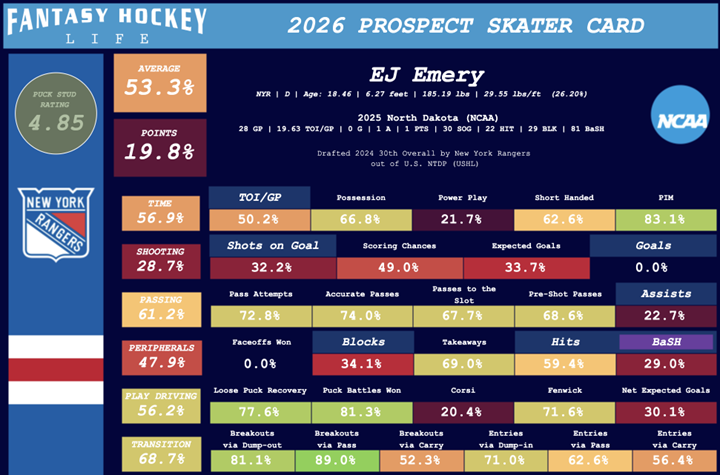

Why Sell?

Emery brings size, reach, and strong defensive instincts, which give him a very clear path to the NHL. He is already advanced as a transition and shutdown defender, and his play at North Dakota reflected that, as seen in his Fantasy Hockey Life skater card. Coaches will love his ability to kill plays early, win battles, and make smart exits under pressure. In real hockey terms, he is the kind of steady, reliable blueliner teams trust in difficult minutes.

However, from a fantasy perspective, his ceiling is extremely limited. He is unlikely to produce many points at the NHL level, and his peripheral contributions are not high enough to offset the lack of offense. While his draft position and defensive reputation may still generate some hype, this is the perfect time to cash out before the fantasy market cools. Emery may become a valuable real-life NHL defenseman, but he is unlikely to ever be a valuable fantasy asset. Dynasty managers should move him now and use the name value while it still holds weight.

Summary

| Player | Role | Key Insight |

| Gabe Perreault | Buy | Elite hockey sense and vision, value still muted by NHL timeline |

| Scott Morrow | Buy | Offensive defender who could climb quickly if given opportunity |

| Dylan Garand | Buy | Under-the-radar goalie with strong backup/1B potential |

| Malcolm Spence | Sell | Raw energy forward, ceiling limited to depth role |

| Brendan Brisson | Sell | Great shot, but crowded depth and inconsistency limit upside |

| EJ Emery | Sell | Safe NHL projection, but minimal fantasy relevance long-term |